The cryptocurrency market as traders start to price in of stabilizing over the last few trading sessions as traders begin to price in the upcoming FOMC statement. While volatility has generally compressed across the primary assets, market movement is still dominated by the expectations of the Federal Reserve policy. XRP, Solana SOL, and Ethereum ETH seem to have strong structural support on the chart, supported by strong network activity and steady on-chain demand. Given that the macro environment still looks vulnerable, the next move will depend on market interpretation. The policy tone expected today will guide that direction.

Market Overview:

The trading situation has marginally improved after the selloffs last week, with Bitcoin stabilizing near its short-term support, beginning to impact the broader sentiment. Major altcoins are all transitioning into tighter consolidation phases, pointing to lower levels of volatility driven by liquidity.

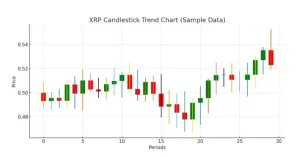

- XRP is trading just below $0.52 and has shown minor accumulation levels.

- Solana is barely holding the $180 price level and is defending its mid-range.

- Ethereum remains around $3240, oscillating close to its short-term moving averages.

Notably, stablecoin inflows in centralized exchanges have increased by 3% over the last 24 hours, suggesting that repositioning has shown minimal risk-off behavior.

Bitcoin & XRP Price Analysis

Daily Timeframe

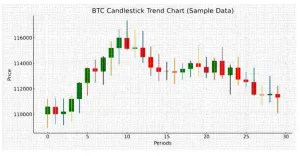

BTC is still trapped between the 100 and 200DMA on the daily timeframe, indicating another compression leading up to volatility expansion.

Supports are listed below: – $108K-$109 before S/R – $115K-$116 S/R – Liquidity target = $120K-$122 prior range high – ATH region = ~$126K A confirmed DCC above $115K would suggest BTC regressing to the upper liquidity pool below, while rejection would speculate BTC back to $108K’s range lows. BTC’s structure continues to be maintained in a healthy on-chain liquidity trough.

XRP Price Analysis:

XRP remains on a sell, flagging along with the prior trajectory’s motion grid. Daily and 4H Structure Supports below: – $0.50-$0.515 S/R – $0.54-$0.55 S/R – $0.56-$0.58 range high. Due to continuous throughput for institutional payments, XRP’s network replacement remains stable. Wallet activations stay constant, and DTs reveal no signs of exhaustion. Breaking above the $0.54 resistance cluster might quickly move XRP into mid-range help from $0.58. The macros will press markets lower unless broad pressure forces Darwin into it.

Transaction Health and Network Activity: On-Chain Data

Settlement Network Stability: XRP

XRP throughput continues to indicate active usage in cross-border payment corridors. Daily transactions are higher and do not exhibit any signs of deterioration. One of the strongest indicators of network activity is its throughput.

High-Performance: Solana

Solana shows one of the strongest engagement levels among smart-contract networks. TVL stands above $11B on active DeFi programs, NFT traffic, and gaming. On-chain throughput also articulates high levels of user engagement despite moderate consolidation.

Ethereum: Layer-2 Expansion and Core Network Strength

Ethereum’s network is migrating towards higher efficiency with prominent adoption of with prominent Layer-2 adoption absorbing more transactional demand. Staking remains active and wallet activity on major L2s continues to accrue, affirming Ethereum’s status as the core settlement layer of Web3.

Market Structure: Liquidity, Volatility, and Technical Behavior

Major altcoin pairs have seen broadly improving liquidity conditions, with spreads narrowing and market makers regaining activity. Volatility indicators, such as ATR and Bollinger Band width, have compressed – a signal of a forthcoming expansion stage. These setups imply limited downside potential unless some major macro disruptions evolve.

- XRP is trading near its short-term moving averages, showing early signs of structural stabilization.

- Solana holds a strong support area in the $165–$175 zone, where buyers have repeatedly stepped in.

- Ethereum maintains a mild upward bias despite broader consolidation, forming a series of higher-timeframe higher lows.

These setups suggest reduced downside risk unless major macro disruptions occur

Poain Insights: Interpreting the Current Market Envoirement

Utility as a Core Strength Indicator

Utility Highlights Poain analysts emphasize that network activity – as opposed to short-term price action – remains the most reliable metric for determining the long-term appeal of a blockchain. XRP’s on-chain usage for settlements, Solana’s high transactional throughput, and Ethereum’s market share in Web3 applications all indicate significant underlying utility.

Liquidity Behavior Across Exchanges

Liquidity Behavior Across Exchanges Liquidity distribution across the order book indicates that traders are adjusting for macro clarity rather than setting up for overextended speculative activity. This is a continuation of the mid-term theme of crowd-sourced trust going into the FOMC’s announcement.

Stablecoin Flow Trends

Stablecoin flows are slightly more risk-averse. As per Poain’s datainvestors are staying liquid on exchanges in anticipation of new opportunities rather than pulling funds off the exchange.

Institutional Hedging Activity

Off-exchange instruments continue to show increased hedging activity among institutions. This generally supports the notion of decisions being made nce macro uncertainty clears.

Conclusion:

This dynamic backdrop, with FOMC’s decision as the focal point, implies a structurally stable attitude toward XRP, Solana, and Ethereum. Volume flows and liquidity positioning, alongside a combination of active networks, suggest the possibility of short-term volatility; however, the on-chain and technical outlooks indicate a favorable environment for recovery-type moves once macro conditions stabilize

About Poain BlockEnergy Inc.

Poain BlockEnergy Inc. (Company Number 20201594933), founded on July 8, 2020, and headquartered at 1401 Lawrence Street, Denver, Colorado, focuses on the pre-sale and staking of Poain Coin (PEB). The company provides data-driven research and transparent market insights to help readers understand digital asset behavior through clear, factual on-chain analysis.

Information contained on this page is provided by an independent third-party content provider. Binary News Network and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]

Comments