Denver, CO – May 13th, 2025 – Qwoted Newswire – Flock, the retirement solution for landlords, today announced a $20 million Series B round, led by Renegade Partners, with participation from existing investors Andreessen Horowitz (a16z), Primary Ventures, Susa Ventures, 1Sharpe Ventures, and others. The funding will support Flock’s expansion into new real estate asset classes, starting with multifamily and manufactured housing, following early success in single-family rentals.

Flock is scaling at a pivotal moment for real estate investors, as more landlords seek tax-efficient exits. Estimates indicate that $6 to $8 trillion or more in equity is currently “trapped” in long-held, low-basis real estate owned by non-institutional landlords who lack clear, cost-efficient exit strategies.*

Meanwhile, interest rates and shifting demographics are reshaping the market; insurance premiums are skyrocketing, and owners with low mortgage rates are reluctant to sell. This lock-in effect is occurring at the same time as the Great Wealth Transfer is expected to pass more than $84 trillion in real estate assets from baby boomers to younger generations over the next 20 years, accelerating the need for tax-efficient exits and simplified solutions for real estate portfolios.

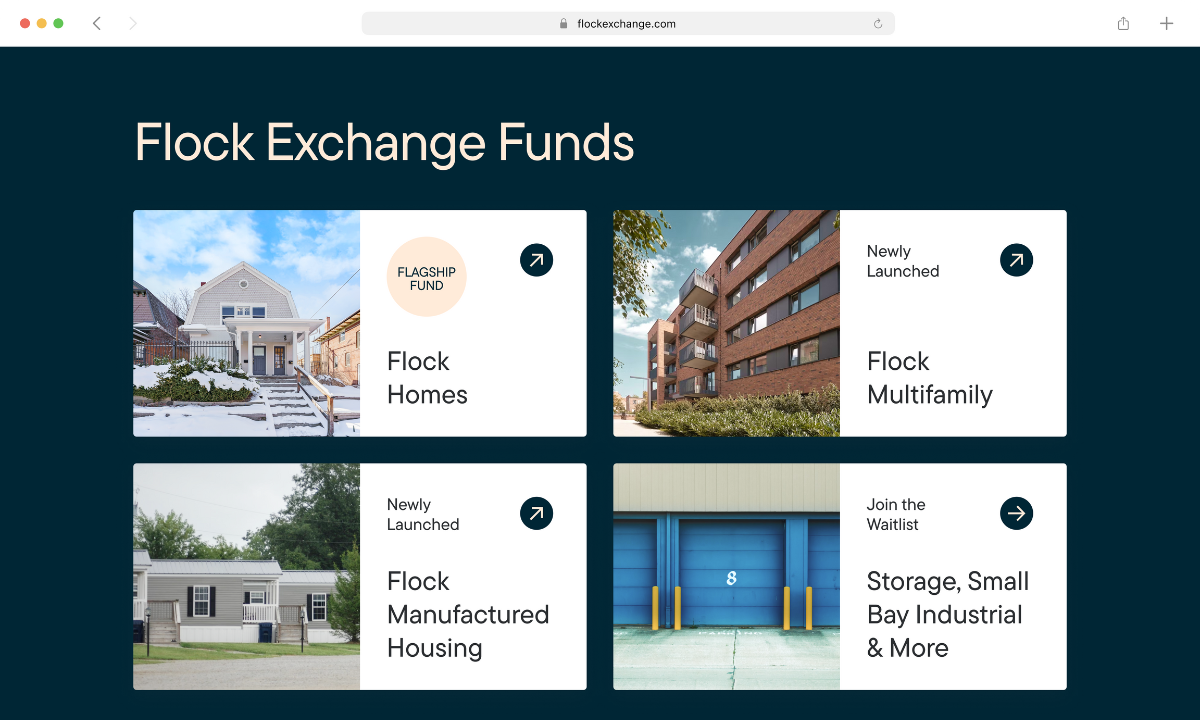

Flock provides real estate owners with an exit without compromise. The company manages over 860 homes across 17 states nationwide, nearing $200 million in total real estate value. With today’s announcement, the Flock platform now offers dedicated funds across key real estate sectors:

- Flock Homes: Single-family rentals

- Flock Multifamily: Multifamily buildings with 5-200 units

- Flock Manufactured Housing: Mobile home communities with 5-500 units

- Flock Storage, Small Bay Industrial, Retail, and more: Coming soon; join the waitlist

“Real estate has been a way to build wealth for many Americans, but at a certain point, it becomes a burden. When we founded Flock four years ago, we embarked on an ambitious mission – to help millions of American landlords unlock equity and transition from headaches to hands-off investing,” said Ari Rubin, Founder and CEO of Flock. “With strong momentum in single-family, we’re bringing this model to multifamily and manufactured housing owners, and eventually to every landlord ready to retire, seeking the most cost-efficient and seamless exit. We’re building a platform that meets property owners where they are – and where they want to go next.”

Flock utilizes the 721 Exchange, a powerful wealth preservation mechanism historically reserved for ultra-high net worth investors, to enable everyday landlords to exchange their properties for shares in Flock’s diversified, professionally managed fund without triggering capital gains taxes. This solution helps preserve cash flow and price appreciation while avoiding the headaches of direct, day-to-day management.

In this era of rising costs and changing market dynamics, Flock’s platform not only offers landlords a tax-efficient transition from active to passive ownership, it also seeks out stronger returns. The company employs a data-driven approach to optimizing rental income, leveraging scale and technology to outperform typical landlords in terms of economic vacancy, loss to lease, and credit loss. Flock properties consistently generate higher total rental income compared to traditional landlords, while offering investors the diversification and stability of institutional management.

“We believe Flock is building a category-defining company at the intersection of real estate, technology, and wealth management,” said Renata Quintini, Co-Founder and Managing Director of Renegade Partners. “Flock is modernizing how real estate wealth is unlocked and managed by transforming complex, burdensome assets into passive, tax-efficient investments accessible to everyday landlords. As demographic and market pressures accelerate, Flock is uniquely positioned to lead this new era of wealth preservation and freedom for property owners.”

Flock’s long-term vision is to provide all landlords with the most cost-efficient and seamless exit through a single platform that spans multiple asset classes. By enabling property owners to step away from day-to-day management while driving stronger performance from their assets, Flock is positioned to create lasting value for owners, residents, and investors alike.

For more information, visit FlockExchange.com.

*Estimate based on analysis of data from the HUD/Census Bureau Rental Housing Finance Survey (2021) and Harvard Joint Center for Housing Studies (2023).

About

Flock helps real estate owners exit active property management while maintaining exposure to income and appreciation through a diversified, professionally managed platform. By leveraging the 721 Exchange, owners can defer capital gains taxes and exchange properties for shares of diversified funds across various asset classes, including single-family homes, multifamily units, manufactured housing, and more. Learn more at www.FlockExchange.com.

Media Contact

Information contained on this page is provided by an independent third-party content provider. Binary News Network and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]

Comments